The over 80 percent decline seen in Bitcoin and other crypto markets may still have you shaking your head. It’s been nearly a year since Bitcoin’s epic, blow off top. Crypto’s subsequent bear market may even have wreaked havoc on your crypto portfolio’s value. You may also struggle to understand the how and why of the crypto market crash. While it’s too late to undo any of your crypto investing mistakes, it’s never too late to do a post-mortem.

Here’s a closer look at the rational reasons for the crypto market’s stunning reversal from unstoppable bull to wounded bear. You’ll also learn how to ID a runaway, bullish market ready to blow apart. In future bull runs, you’ll be able to grab profits by selling into market strength. You’ll no longer get whacked trying to sell after a panic-induced stampede for the exits hits.

Key Dynamics of the 2015-2017 Crypto Market Mania

Fundamentals

Toward the end of 2015, major financial news networks had taken an interest in Bitcoin and other cryptos. Bitcoin eventually finished 2015 on a strong note, up nearly 40 percent. Investors compared those strong returns to the volatile, near zero-gain ride seen in the S&P 500 index during August-December 2015. The famed Winklevoss twins were also in the financial news. Perhaps their status as rich, tech-savvy innovators and investors also began to turn the heads of demanding investors toward the crypto markets.

[thrive_leads id=’5219′]

Around the same time, more and more crypto-centric education and commentary began to promulgate across the internet. Social media began buzzing about the supposed certainty of Bitcoin one day replacing antiquated, government-run fiat money systems. Even kids began to learn about blockchain technology, decentralized digital currency, smart contracts, and crypto mining rigs. New crypto exchanges opened for business. Gemini, a Winklevoss- founded exchange, fully opened in October 2015.

Apparently, not even the memory of the infamous Mt. Gox crypto heist (and subsequent bankruptcy) of early 2014 was enough to dampen the enthusiasm of new crypto investors. This new, widespread awareness of Bitcoin, cryptocurrencies, and the blockchain helped set the stage for the spectacular crypto market rally. But a powerful, precipitating event was still needed to get Bitcoin into sustained rally mode.

Technicals

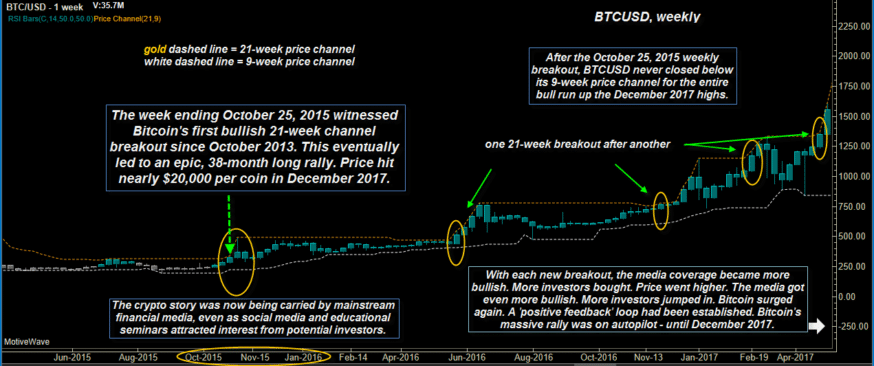

In October 2015, a long-anticipated technical event happened. Bitcoin’s first 21-week bullish channel breakout (closing basis) since October 2013 occurred. Check out this chart:

Bitcoin’s rally proved so strong that it never again closed below the lower (nine-week) price channel until well after December 2017’s parabolic rise and subsequent blow off top. All told, there were seven bullish weekly channel breakouts (Oct. 2015 – Oct. 2017). As the rally gained strength, price corrections were very small, more like pauses rather than pullbacks.

Positive Feedback

When the crypto market entered that powerful bull phase, a positive feedback loop became evident. It went something like this: Bitcoin made a strong breakout. The news media reported this far and wide, citing bullish fundamentals or analyst upgrades, etc. for the surge higher. Investors heard the news and bought. Bitcoin surged once again. Some profit taking occurred and the price went sideways for a few weeks.

Then Bitcoin made yet another channel breakout.

The news media again pounded the table, focused on Bitcoin’s long-term growth potential. Even more investors piled in. The rally started to accelerate more rapidly. Those on the sidelines were fearful of missing out. They started to buy aggressively, blind to the technical state of the charts. The news media had a field day, with ever-higher Bitcoin price targets bandied about by analysts, hedge funds, and crypto gurus. Another minor stall occurred. Investors bought the stall, afraid of missing the next leg higher. On and on it continued.

Predictable Cycles of Investor Sentiment

Finally, after six breakout, bullish news, and investor follow-through cycles, the final bullish breakout happened. That occurred on October 15, 2017, when Bitcoin closed at $5862.69. The coin leaped higher once again, drawing in fresh money. By November 26, 2017, Bitcoin’s weekly chart confirmed a parabolic (beginning to accelerate vertically) uptrend as it closed at $9474.62.

That’s when the mania phase began. As mass greed replaced common sense, some (most?) new investors apparently lost the ability to calculate rational risk-to-reward outcomes. Fear of missing out (FOMO) morphed into get on-board at any cost (GOBAAC?). Once again, the positive feedback loop was at work. Bullish breakouts caused bullish news and opinions to gain ever more acceptance. Later-stage investors continued to buy into Bitcoin’s relentless, parabolic ascent with little regard to the danger of a blow-off top.

Uncool at Any Price

During the final ramp higher into a blow-off top, opposing, bearish arguments may have been dismissed as uncool, old-fashioned, or even downright stupid. Price targets of three, five, or even ten times higher than current valuations may also have been viewed as realistic by less-educated investors. Mass greed, combined with unrealistic expectations (by late entrants into the rally) were certainly key factors propelling Bitcoin from $9474.62 to $19,870.62, during October – December 2017.

Mass Greed Led to an Unsustainable Rally

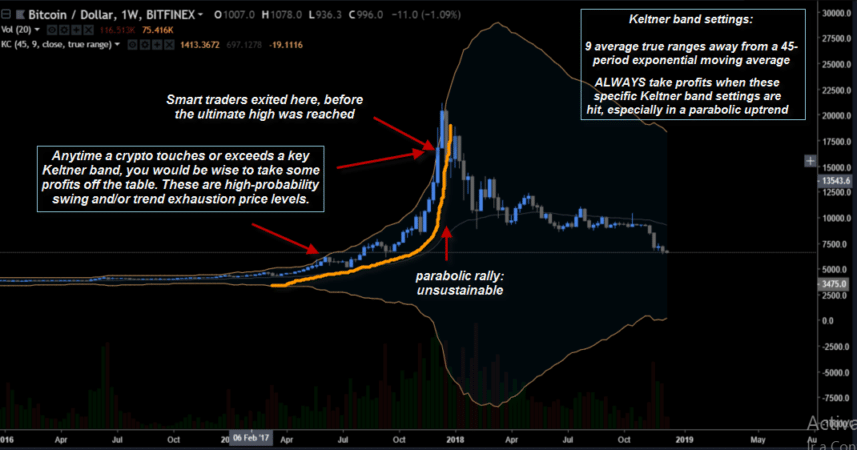

If there is a simple takeaway from the above chart, it’s this:

- Anytime a crypto market touches or exceeds a Keltner band setting of nine average true ranges (ATR) beyond a 45-period exponential moving average (EMA), you should take some, if not all of your open profits.

- If the above scenario occurs in a parabolic, runaway bull market, take all of your profits, or risk having them taken away from you. Pro traders are exiting there (or even sooner). They know full well that the potential for more upside is very small.

Why Did the Crypto Market Crash?

To review, the crypto market crash happened because of several factors. Here’s how it played out in Bitcoin:

- Bitcoin became a highly popular topic in the financial news media in late 2015.

- Investors, faced with a perceived lack of opportunity elsewhere, fueled Bitcoin’s late 2015 breakout.

- The news media pounced on the breakout, citing Bitcoin’s long-term investment potential.

- The bullish news incited other investors to put money to work in Bitcoin.

- Prices surged higher. The news media continued to ride the hot market higher. More investors became interested. A positive feedback loop became evident.

- Profit-taking occurred, but prices merely traded sideways. Fear of missing out quickly ignited a new breakout, as new investors continued to pile in.

- Bitcoin surged ever higher, beginning a parabolic, near-vertical ascent in mid-November 2017.

- Late-stage investors were mostly driven by FOMO, greed, and ignorance of market technicals.

- Analysts and traders urging caution to newcomers were written off as kooks, unhip, or blind to opportunity.

- Pro traders continually sold portions of their Bitcoin into strength as prices surged higher in its parabolic ascent.

- New traders and investors were the ones doing the Bitcoin buying, with the pros selling them all they could handle.

- Finally, the supply of new investors simply dried up. There were no more takers for Bitcoin at a price above $19,870.62.

- Pro traders began to short Bitcoin futures and Bitcoin. The price began to plummet. And, many latecomer investors were blindsided and sold at a big loss.

- As price declined, uneducated investors attempted to call a bottom. Most failed to profit, as rallies were short-lived. Pro traders sold every rally, making money.

Start out Greedy, End up Needy

The saddest stories were the investors who bought in during the parabolic rally. Many never took profits on the way up, and instead saw their open profits turn into massive losses. How tragic, allowing a great bull market opportunity go to waste! By all means, do whatever it takes to avoid suffering a similar fate.

You now know how to identify a mass greed-driven bull market. You can certainly make lots of money as a market shifts into such a unidirectional mode. However, all such bull phases end with a spectacular, parabolic rally and an unsightly explosion at the tippy-top. So make sure you always protect yourself by using the commonsense profit-taking guidelines presented above.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.